In today’s quick-paced monetary panorama, the necessity for fast access to money has become extra prevalent than ever. Whether or not it’s for unexpected medical expenses, automobile repairs, or unplanned bills, many individuals find themselves in situations the place they require quick funds. Traditional lending routes often involve lengthy approval processes and stringent credit checks, making them lower than preferrred for those in urgent need of cash. This is where fast loans with no credit check come into play, offering a possible solution for borrowers looking for quick monetary relief.

Understanding Quick Loans

Quick loans are designed to supply borrowers with immediate access to money, often inside a short interval, usually the identical day. The applying process is often streamlined, allowing people to safe funds quickly with out the lengthy documentation that conventional loans require. These loans can come in various forms, including payday loans, personal loans, and installment loans, every with its personal particular terms and situations.

The Attraction of No Credit Check Loans

One in all the first benefits of fast loans at present is the choice for no credit check. For a lot of individuals, especially these with poor credit histories or no established credit score, the prospect of being denied a loan on account of credit score scores can be disheartening. no credit check personal loans guaranteed approval credit check loans provide another for these borrowers, as lenders do not assess their creditworthiness by means of traditional means.

The enchantment of no credit check loans lies of their accessibility. Many lenders who provide these kinds of loans give attention to other elements, reminiscent of income verification, employment standing, and checking account history, which could make it simpler for borrowers to qualify. This can be notably beneficial for individuals who could have skilled monetary difficulties previously however are presently in a stable place to repay a loan.

How briskly Loans Work

The means of obtaining a quick loan with no credit check is mostly straightforward. Borrowers can typically apply on-line, offering basic data such as their name, contact particulars, revenue, and banking data. As soon as the application is submitted, lenders will overview the knowledge and will conduct a delicate inquiry into the applicant’s monetary history, which does not have an effect on their credit score rating.

If permitted, borrowers can anticipate to receive funds quickly, often within 24 hours. Nevertheless, it is crucial to understand the phrases of the loan, together with curiosity rates, repayment schedules, and any associated charges. Fast loans typically come with larger curiosity rates in comparison with conventional loans, reflecting the elevated danger lenders take by not performing credit score checks.

Pros and Cons of Fast Loans with No Credit Check

As with all financial product, quick loans with no credit check come with their own set of advantages and disadvantages. Understanding these can help borrowers make knowledgeable selections.

Execs:

- Quick Entry to Funds: The most significant benefit is the speed of approval and disbursement, allowing borrowers to deal with urgent financial needs with out delay.

- No Credit Check Required: This opens up alternatives for those with poor credit score or no credit historical past to safe funding.

- Simplified Utility Course of: The application process is commonly less complicated than conventional loans, making it accessible to a broader viewers.

Cons:

- Higher Curiosity Charges: Quick loans usually include higher curiosity rates, which may result in significant repayment quantities over time.

- Quick Repayment Phrases: Many fast loans require repayment within a brief period, which might be difficult for some borrowers.

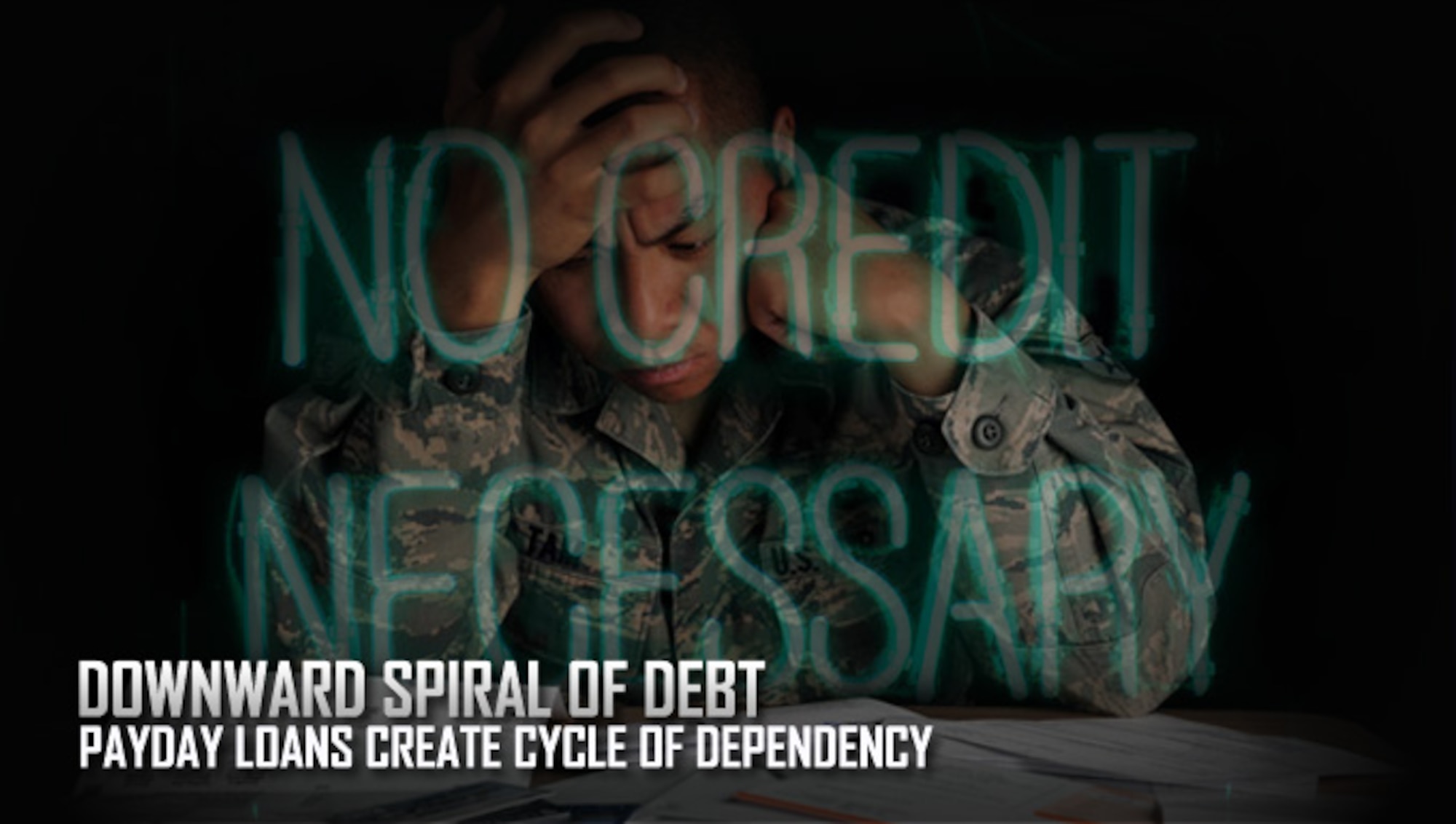

- Potential for Debt Cycle: Borrowers may discover themselves in a cycle of debt if they cannot repay the loan on time and are pressured to take out further loans to cover the prices.

Accountable Borrowing Practices

While quick loans with no credit checks can provide rapid relief, it's crucial for borrowers to strategy them with caution. Listed here are some accountable borrowing practices to contemplate:

- Assess Your Financial Scenario: Before making use of for a loan, consider your current financial standing. Decide in the event you genuinely need the funds and if you may afford to repay the loan inside the required timeframe.

- Analysis Lenders: Not all lenders are created equal. Take the time to analysis and examine completely different lenders, their terms, and their fame. Look for critiques and testimonials from earlier borrowers to gauge their reliability.

- Perceive the Phrases: Rigorously learn the loan agreement to grasp the interest rates, fees, and repayment terms. Ensure there are not any hidden costs that might catch you off guard later.

- Have a Repayment Plan: Earlier than taking out a loan, create a repayment plan. Consider how you'll handle your price range to make sure you may make well timed funds and avoid falling into a debt cycle.

Alternate options to Fast Loans

While quick loans with no credit check can be a viable possibility for some, they aren't the only resolution for financial emergencies. Listed here are just a few options to think about:

- Personal Loans from Credit Unions: Many credit unions offer personal loans with competitive curiosity charges and versatile phrases. They may even be more lenient on credit requirements compared to traditional banks.

- Borrowing from Associates or Household: If doable, consider seeking monetary help from buddies or household. This option may come with extra flexible repayment phrases and lower or no interest.

- Cost Plans: If the monetary want is related to a specific bill or expense, inquire about payment plans with service providers. Many firms are prepared to work with customers to determine manageable cost schedules.

- Credit score Counseling Services: If you find yourself struggling with debt, consider reaching out to a credit counseling service. These organizations can aid you develop a funds, negotiate with creditors, and create a plan for managing your funds.

Conclusion

Quick loans in the present day with no credit check can provide a lifeline for individuals dealing with unexpected financial challenges. Nevertheless, it is crucial to approach these loans with caution and a transparent understanding of the phrases and potential dangers concerned. By practising responsible borrowing and exploring all obtainable choices, borrowers can make knowledgeable decisions that finest swimsuit their financial needs. In the end, while quick loans can supply quick relief, maintaining a healthy financial outlook ought to at all times stay a priority.