Lately, the concept of Gold Individual Retirement Accounts (IRAs) has gained appreciable traction among buyers searching for to diversify their retirement portfolios. Gold IRAs permit individuals to spend money on bodily gold and different treasured metals as part of their retirement financial savings. This report delves into the workings of Gold IRAs, their benefits and drawbacks, regulatory concerns, and the overall market landscape.

Understanding Gold IRAs

A Gold IRA is a sort of self-directed Particular person Retirement Account that permits buyers to carry bodily gold, silver, platinum, and palladium in their portfolios. In contrast to conventional IRAs, which typically encompass stocks, bonds, and mutual funds, Gold IRAs present a novel alternative to invest in tangible property. The interior Revenue Service (IRS) has particular guidelines regarding the types of metals that may be held in these accounts, which must meet certain purity requirements.

Sorts of Treasured Metals Allowed

The IRS permits the next types of bullion and coins to be held in Gold IRAs:

- Gold Bullion: Will need to have a purity of 99.5% or higher.

- Silver Bullion: Should have a purity of 99.9% or increased.

- Platinum Bullion: Must have a purity of 99.95% or higher.

- Palladium Bullion: Should have a purity of 99.95% or greater.

- Approved Coins: Sure coins, resembling American Gold Eagles, Canadian Maple Leafs, and others that meet the IRS criteria.

Organising a Gold IRA

Establishing a Gold IRA includes a number of steps:

- Select a Custodian: Buyers must select an IRS-permitted custodian to handle their Gold IRA. If you have any sort of concerns relating to where and how you can utilize trusted companies for gold iras, you can call us at our site. The custodian is answerable for holding the physical metals and guaranteeing compliance with IRS rules.

- Fund the Account: Traders can fund their Gold IRA by means of various methods, including rolling over funds from an existing retirement account (like a 401(okay) or conventional IRA) or making direct contributions.

- Select Treasured Metals: As soon as the account is funded, investors can select which kinds of treasured metals to buy. The custodian typically gives a list of approved dealers and choices.

- Storage: The bodily gold should be saved in an IRS-approved depository. Buyers can't keep the metals at residence, as this could violate IRS regulations.

Advantages of Gold IRAs

- Inflation Hedge: Gold has historically been considered as a safe-haven asset during times of financial uncertainty. It tends to retain its worth, making it a well-liked choice for hedging towards inflation.

- Portfolio Diversification: Gold can provide diversification advantages, as its worth movements usually differ from conventional asset classes like stocks and bonds. This can assist reduce total portfolio risk.

- Tax Benefits: Like traditional IRAs, Gold IRAs supply tax-deferred development. Buyers do not pay taxes on gains till they withdraw funds during retirement.

- Safety In opposition to Forex Fluctuations: Gold is a global foreign money that's not tied to any specific authorities or economic system. This characteristic can protect traders from forex devaluation and geopolitical dangers.

Drawbacks of Gold IRAs

- Limited Investment Choices: While Gold IRAs present exposure to treasured metals, they don't offer the same range of investment choices as conventional IRAs, which may embody stocks, bonds, and mutual funds.

- Increased Fees: Gold IRAs usually include higher charges in comparison with traditional IRAs. These fees could include custodian fees, storage fees, and transaction fees when shopping for or selling metals.

- Market Volatility: The price of gold could be unstable, influenced by various components resembling provide and demand, geopolitical occasions, and modifications in monetary coverage. This volatility can pose dangers for buyers.

- Regulatory Compliance: Buyers should ensure that their Gold IRA complies with IRS rules, which may be complex. Failure to comply could end in penalties and taxes.

Regulatory Concerns

The IRS has strict rules governing Gold IRAs to forestall tax evasion and ensure compliance. Key regulations embody:

- Purity Standards: As talked about earlier, solely sure varieties of gold and other precious metals are allowed in Gold IRAs.

- Storage Necessities: The metals must be stored in an IRS-accepted depository, which ensures their safety and compliance with regulations.

- Reporting Necessities: Buyers should report transactions and holdings to the IRS, including any distributions taken from the account.

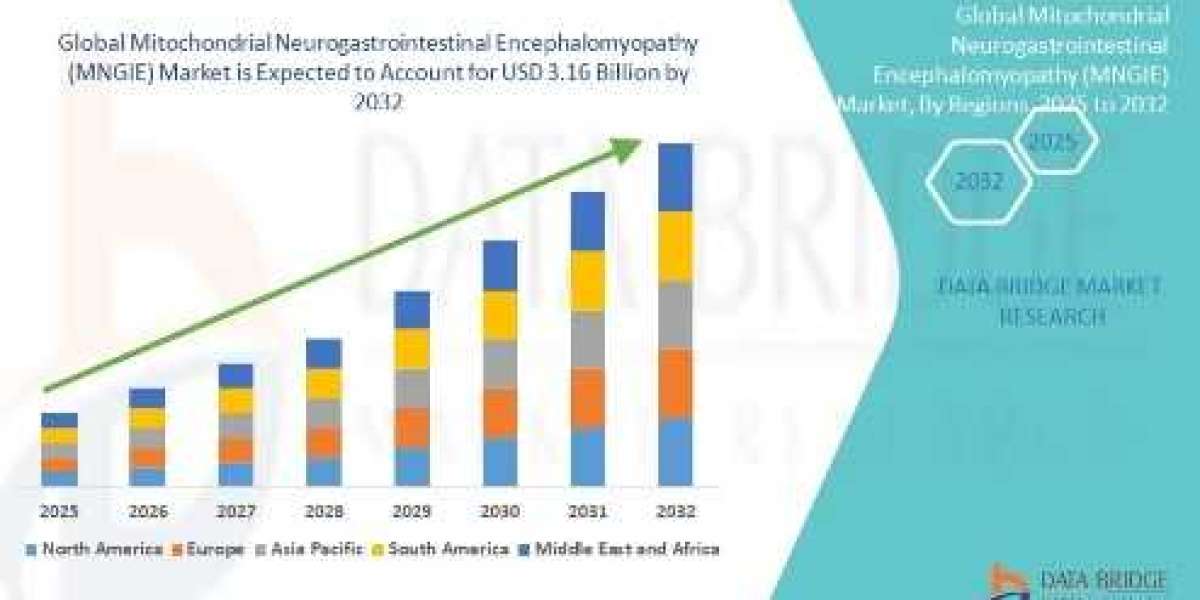

The Market Panorama

The marketplace for Gold IRAs has expanded considerably over the past decade. With growing financial uncertainty and inflation issues, many traders are turning to valuable metals as a technique of protecting their wealth. Numerous companies now supply Gold IRA companies, providing investors with a spread of choices for custodians, storage trusted options for ira rollover in gold-backed investments, and treasured metal dealers.

Conclusion

Gold IRAs signify a unique funding alternative for individuals trying to diversify their retirement portfolios with precious metals. Whereas they offer numerous benefits, together with inflation safety and tax benefits, potential investors should additionally consider the drawbacks, such as greater charges and regulatory complexities. As with all investment, thorough analysis and session with monetary advisors are essential for making informed selections. Overall, Gold IRAs generally is a valuable addition to a effectively-rounded retirement strategy, particularly in occasions of economic uncertainty.