In recent times, the funding landscape has experienced a major transformation, significantly in the realm of retirement financial savings.

In recent years, the funding landscape has experienced a major transformation, particularly in the realm of retirement savings. Among the assorted funding choices obtainable, Gold Particular person Retirement Accounts (IRAs) have gained considerable attention. As investors seek to diversify their portfolios and protect their wealth in opposition to inflation and financial uncertainty, Gold IRAs have emerged as a viable solution. This article explores the demonstrable advances in Gold IRA investments, highlighting current traits, benefits, and the evolving regulatory landscape that makes gold a compelling choice for retirement savings.

Understanding Gold IRAs

A Gold IRA is a self-directed retirement account that permits traders to hold physical gold, in addition to other valuable metals, as part of their retirement portfolio. In contrast to conventional IRAs that primarily hold stocks, bonds, and mutual funds, Gold IRAs provide an avenue for investing in tangible assets which have traditionally retained their worth. This unique feature has made Gold IRAs more and more common amongst traders seeking to hedge towards market volatility and inflation.

Latest Traits in Gold IRA Investments

- Elevated Reputation and Consciousness

The recent economic climate, characterized by rising inflation charges and geopolitical tensions, has led to a surge in demand for Gold IRAs. If you have any sort of questions relating to where and ways to utilize

trusted companies for gold ira rollover ira companies for retirement gold investments;

https://www.healthnow.health,, you can call us at our web site. Buyers are becoming extra aware of the benefits of diversifying their retirement portfolios with precious metals. Monetary advisors and funding corporations are additionally promoting Gold IRAs as a strategic asset class, further driving curiosity among potential traders.

- Technological Advancements

The mixing of expertise into the investment process has made it easier for people to set up and manage Gold IRAs. On-line platforms and investment apps now offer seamless entry to Gold IRA accounts, allowing traders to observe their holdings, execute transactions, and entry academic

sources from the comfort of their properties. This technological shift has democratized entry to Gold IRAs, making it more appealing to a broader viewers.

- Enhanced Regulatory Framework

The regulatory setting surrounding Gold IRAs has developed, providing traders with higher protection and transparency. The inner Income Service (IRS) has established clear guidelines regarding the kinds of gold and different valuable metals that can be held in an IRA. Recent clarifications have emphasized the significance of using accredited custodians and depositories, guaranteeing that investors’ assets are securely stored and compliant with IRS regulations.

- Various Investment Choices

Investors now have access to a wider vary of gold merchandise that may be included of their IRAs. Whereas conventional Gold IRAs typically focused on bullion coins and bars, advancements have led to the inclusion of different forms of precious metals, equivalent to silver, platinum, and palladium. This diversification permits investors to tailor their portfolios to their specific threat tolerance and funding objectives.

- Academic Resources and Help

As the recognition of Gold IRAs continues to grow, so does the availability of instructional assets. Many funding corporations and custodians now supply comprehensive guides, webinars, and one-on-one consultations to assist buyers understand the intricacies of Gold IRAs. This emphasis on schooling empowers traders to make informed choices about their retirement financial savings.

Benefits of Investing in Gold IRAs

- Inflation Hedge

One among the first causes traders flip to Gold IRAs is the asset's historic potential to serve as a hedge in opposition to inflation. Because the buying power of fiat currencies declines over time, gold has constantly maintained its worth, making it a pretty choice for preserving wealth in the long term.

- Portfolio Diversification

Gold IRAs present a possibility for buyers to diversify their retirement portfolios beyond conventional property. By together with gold and other treasured metals, investors can scale back general portfolio risk and enhance potential returns, significantly throughout periods of economic uncertainty.

- Tax Advantages

Like conventional IRAs, Gold IRAs provide tax-deferred development, that means that investors don't pay taxes on their positive factors until they withdraw funds during retirement. This tax advantage can significantly improve the general returns on funding over time.

- Tangible Asset

In contrast to stocks or bonds, gold is a tangible asset that traders can bodily hold. This intrinsic worth can provide peace of mind, especially during occasions of financial instability. The flexibility to own physical gold will be notably interesting to those that prioritize safety and stability in their retirement planning.

Challenges and Considerations

Whereas Gold IRAs present quite a few advantages, potential buyers also needs to bear in mind of the challenges associated with this investment vehicle. One of the first considerations is the fees associated with organising and sustaining a Gold best ira gold options. Custodial charges, storage charges, and transaction costs can add up, doubtlessly impacting total returns. Moreover, buyers should conduct thorough research to pick reputable custodians and sellers to ensure the safety of their belongings.

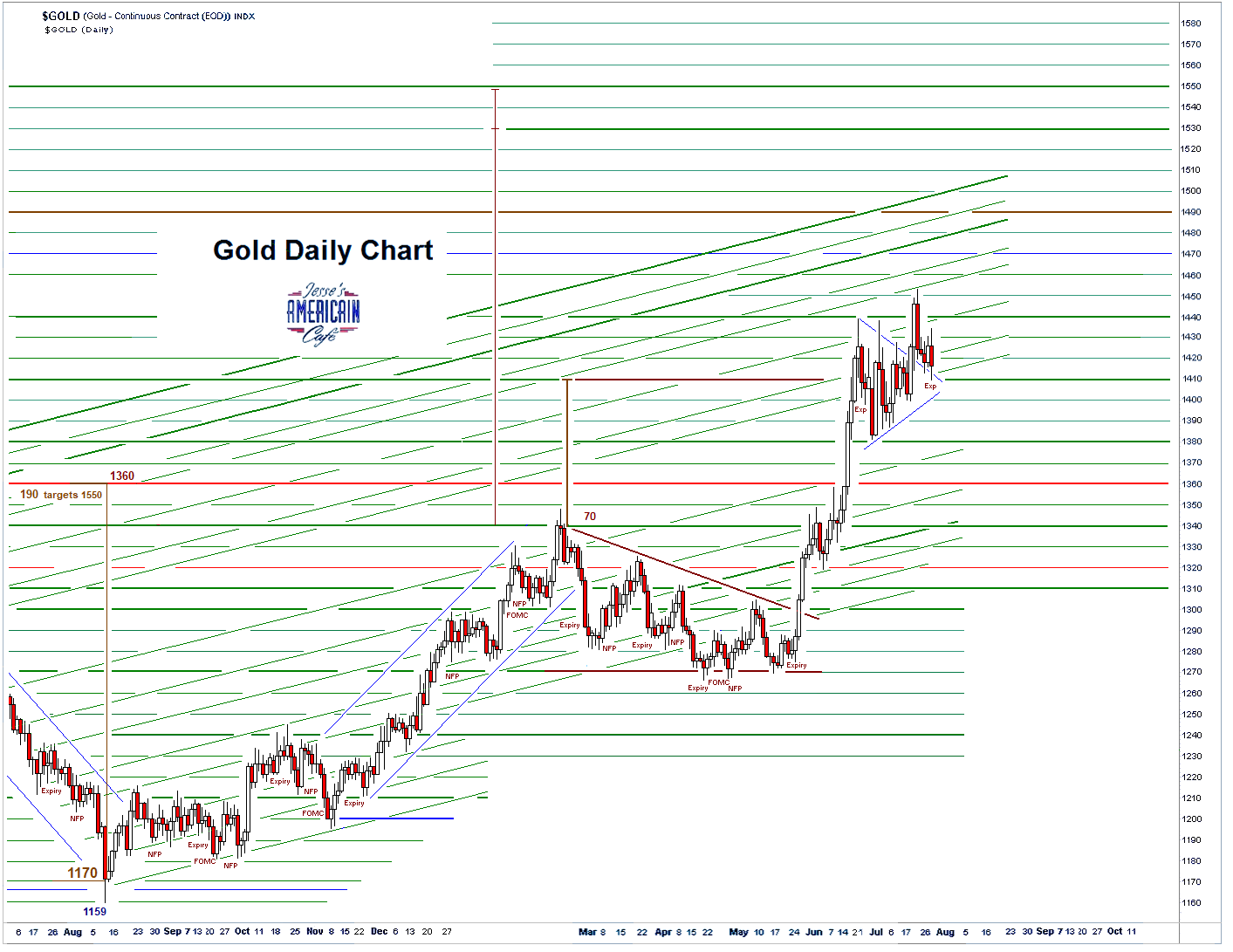

One other consideration is the volatility of gold costs. Whereas gold has traditionally been a stable retailer of value, its value can fluctuate based mostly on market circumstances, geopolitical occasions, and adjustments in investor sentiment. Because of this, traders ought to be prepared for potential worth swings and align their funding strategy with their risk tolerance.

Conclusion

The developments in Gold IRA investments replicate a growing recognition of the importance of diversification and asset protection in retirement planning. As economic uncertainties persist, investors are more and more turning to Gold IRAs as a strategic solution to safeguard their wealth. With enhanced regulatory frameworks, technological improvements, and a wealth of academic sources, the panorama of Gold IRA investments has evolved to better serve the wants of modern traders. By understanding the advantages and challenges associated with Gold IRAs, people could make informed decisions that align with their long-term financial goals, in the end paving the way in which for a safe and prosperous retirement.